10 Tips for Using AI in Your Stock Trading Strategy

As the financial markets continue to evolve, the incorporation of artificial intelligence (AI) into stock trading strategies has become increasingly prevalent. AI-powered trading systems provide a significant edge by harnessing real-time data, predictive analytics, and advanced pattern recognition capabilities. Software for trading stocks with AI integration plays a pivotal role in this transformation, empowering traders with sophisticated analytical tools and automated trading functionalities.

Whether you're a seasoned trader or just starting out, leveraging AI can enhance your trading performance and help you make more informed decisions. In this comprehensive guide, we'll explore 10 essential tips for effectively incorporating AI into your stock trading strategy.

1. Leverage Real-Time Market Data

Key Insight: AI trading systems excel by integrating and analyzing live data streams, allowing for immediate reactions to market movements.

Actionable Tip: Prioritize AI trading tools that offer robust real-time data integration capabilities for sharper, on-the-fly decision-making.

The ability to process and respond to real-time market data is a hallmark of successful AI-driven trading strategies. Integrating live data feeds from various sources, such as stock exchanges, economic indicators, and news events, allows AI systems to quickly identify and act on emerging trends and opportunities.

Look ai for stock trading platforms that seamlessly integrate real-time data streams, enabling your AI-powered strategies to make timely, data-driven decisions. This can give you a competitive edge in fast-moving markets, where the ability to react swiftly can make all the difference.

2. Incorporate Effective Risk Management Protocols

Key Insight: Foundationally, AI systems should include advanced risk management protocols to safeguard investments.

Actionable Tip: Ensure your AI trading software includes features for setting loss limits and hedging strategies to protect your capital.

While AI-powered trading systems can enhance your returns, they also introduce new risks that must be carefully managed. Incorporating robust risk management protocols is crucial for protecting investments and ensuring the long-term viability of your trading strategy.

Look for AI trading tools that offer advanced risk management features, such as:

- Stop-loss orders: Automatically execute trades to limit potential losses when a stock reaches a predetermined price level.

- Position sizing: Determine appropriate trade sizes based on your risk tolerance and available capital.

- Hedging strategies: Implement hedging techniques, like options or futures contracts, to mitigate market downside.

Prioritizing risk management allows you to leverage AI's power while safeguarding your portfolio against unexpected market fluctuations.

3. Utilize Predictive Analytics for Market Trends

Key Insight: Machine learning within AI trading systems can forecast future market trends with remarkable accuracy.

Actionable Tip: Opt for trading software that leverages predictive analytics, allowing you to make informed decisions based on historical and current market data.

One of the key advantages of AI in stock trading is its ability to analyze vast amounts of historical and real-time data to identify patterns and predict future market trends. Through the application of machine learning algorithms, AI-powered systems can recognize complex relationships and make highly accurate forecasts.

Incorporating predictive analytics into your trading strategy provides valuable insights into market direction, sector rotations, and individual stock performance. This can help you make more informed decisions, such as:

- Timing market entries and exits: Identify opportune moments to buy or sell based on predicted price movements.

- Sector allocation: Allocate capital to sectors and industries that are expected to outperform.

- Stock selection: Identify stocks with the highest potential for growth or stability based on predicted performance.

Look for AI trading platforms that offer robust predictive analytics capabilities, empowering you to make data-driven, forward-looking investment decisions.

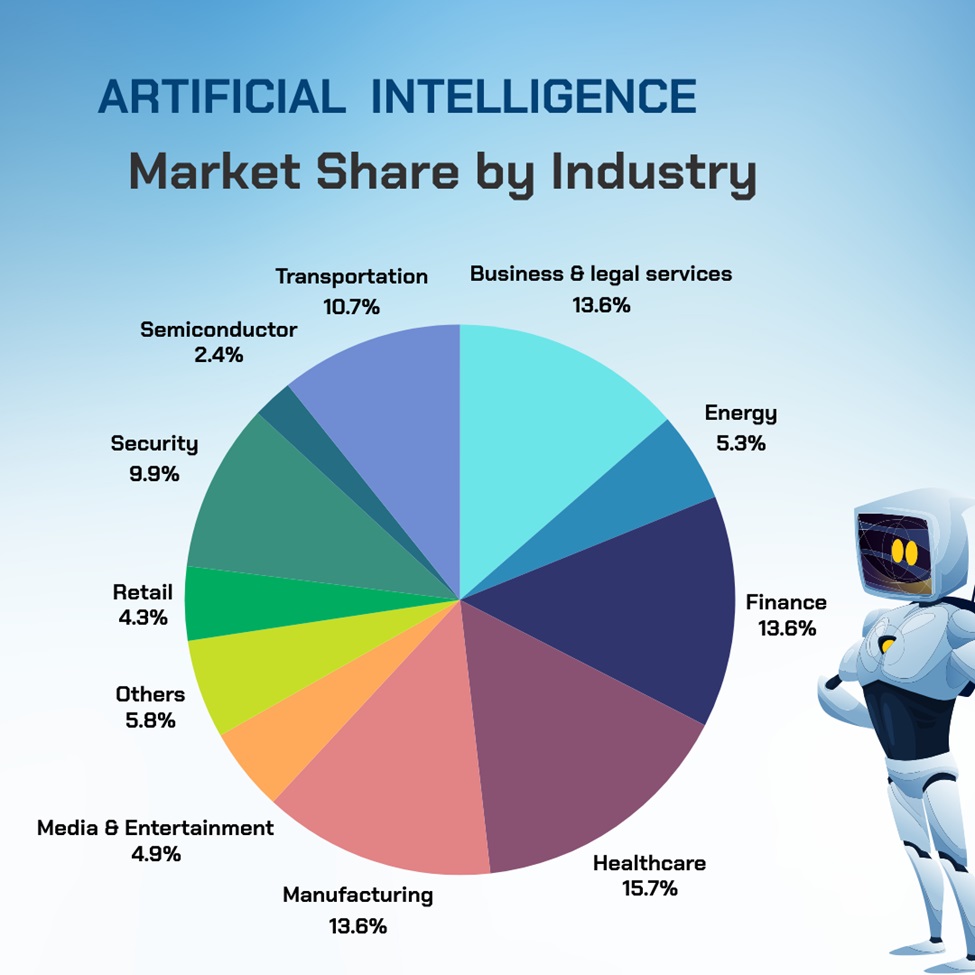

Source: Statista

4. Employ Pattern Recognition for Technical Analysis

Key Insight: AI's ability to recognize market patterns can reveal trading opportunities and risks.

Actionable Tip: Select AI tools with strong pattern recognition capabilities to identify and act on technical market indicators.

Technical analysis is a fundamental aspect of successful stock trading, and AI can significantly enhance this process. By leveraging advanced pattern recognition algorithms, AI systems can identify complex technical patterns and indicators that may be difficult for human traders to detect.

From identifying support and resistance levels to recognizing candlestick formations, AI-powered technical analysis can provide valuable insights and trading signals. By empowering your trading strategy with AI-driven pattern recognition, you can:

- Identify entry and exit points: Recognize chart patterns and technical indicators that signal opportune times to buy or sell.

- Spot emerging trends: Detect the formation of new trends, whether bullish or bearish, to position your portfolio accordingly.

- Manage risk: Identify potential support or resistance levels to set appropriate stop-loss orders and manage your risk exposure.

Seek out AI trading platforms that offer robust pattern recognition capabilities, allowing you to capitalize on technical market insights that may be invisible to the naked eye.

5. Emphasize User Interface and Experience

Key Insight: A well-designed user interface enhances the usability and efficiency of AI trading software.

Actionable Tip: Choose AI platforms with intuitive, customizable interfaces that match your trading workflow and preferences.

As AI-powered trading systems become more sophisticated, the importance of a user-friendly interface cannot be overstated. A well-designed and customizable platform can significantly improve your trading experience and productivity. In this context, exploring AI software for trading stocks that prioritizes ease of use is crucial. Look for AI trading tools that offer the following user interface features:

- Intuitive dashboard: A clear, organized dashboard that provides quick access to key trading metrics, market data, and AI-generated insights.

- Customizable layouts: The ability to personalize the display of information and trading tools to suit your individual preferences and workflow.

- Seamless integration: Smooth integration with your existing trading platforms, brokerages, and portfolio management tools.

- Responsive design: A mobile-friendly interface that allows you to monitor and execute trades on the go.

By prioritizing the user experience, you can ensure that your AI trading system complements your trading style, enhancing your efficiency and decision-making capabilities.

6. Ensure Regulatory Compliance and Security

Key Insight: Compliance with financial regulations and data protection standards is critical for legal and secure trading operations.

Actionable Tip: Verify that your AI trading software adheres to industry regulations and employs robust data protection measures.

As you incorporate AI into your stock trading strategy, it's essential to ensure that your chosen tools and platforms comply with relevant financial regulations and data security standards. Failure to do so can expose you to legal risks, financial penalties, and potential data breaches.

When evaluating AI trading solutions, consider the following compliance and security factors:

- Regulatory adherence: Confirm that the AI trading software is compliant with applicable financial regulations, such as the Securities and Exchange Commission (SEC) rules and the Financial Industry Regulatory Authority (FINRA) guidelines.

- Data protection: Ensure the platform employs robust data encryption, access controls, and other security measures to safeguard your sensitive trading and personal information.

- Disaster recovery: Verify that the AI trading system has comprehensive backup and disaster recovery protocols to protect your data and trading records.

By prioritizing compliance and security, you can confidently leverage AI-powered trading systems while maintaining the necessary safeguards for your investments and personal data.

7. Explore Third-Party AI Trading Tools

Key Insight: In the world where The market size of the Artificial Intelligence market is projected to reach US$305.90bn in 2024. When built-in tools are insufficient, third-party AI solutions can offer deeper analysis and more tailored portfolio management.

Actionable Tip: Investigate specialized AI trading solutions outside of your current platform to better align with your investment strategies.

While many brokerages and trading platforms offer their own AI-powered tools, the market is also rife with specialized third-party AI solutions that can complement or enhance your existing setup. Exploring these external AI trading tools can provide you with more comprehensive analysis, advanced portfolio management capabilities, and greater flexibility to tailor your trading strategy.

Some examples of third-party AI trading tools to consider include:

- AI-driven stock screeners: Leverage machine learning algorithms to identify stocks with specific characteristics, such as growth potential or undervaluation.

- Portfolio optimization software: Utilize AI to optimize your asset allocation, diversification, and risk management based on your investment objectives and risk tolerance.

- Automated trade execution: Implement AI-powered trading bots to execute trades based on pre-defined rules and market conditions.

By integrating these specialized AI tools into your trading workflow, you can unlock deeper insights, more granular control, and greater alignment with your unique investment approach.

8. Integrate AI Tools for a Hybrid Approach

Key Insight: Combining standalone AI tools with your existing setup can provide a more comprehensive trading strategy.

Actionable Tip: Consider integrating external AI-driven stock screeners or portfolio management tools with your brokerage platform.

While AI-powered trading platforms can offer a comprehensive suite of features, there may be instances where standalone AI tools can complement or enhance your overall trading strategy. Adopting a hybrid approach by integrating external AI solutions with your existing setup can provide a more robust and tailored solution.

Some examples of how you can integrate AI tools into your trading workflow include:

- Incorporating AI-driven stock screeners: Use specialized AI-powered stock screening tools to identify potential investment opportunities that align with your trading criteria, and then execute trades through your brokerage platform.

- Leveraging AI portfolio management: Integrate AI-powered portfolio optimization software to help manage your asset allocation, diversification, and risk exposure, while still executing trades through your preferred trading platform.

- Automating trade execution: Combine your AI-powered trading strategies with automated trade execution capabilities to streamline your decision-making and order placement processes.

By seamlessly integrating these AI-driven tools with your existing trading infrastructure, you can create a more comprehensive and efficient trading system that leverages the strengths of both AI and your own market expertise.

9. Customize AI Tools to Fit Your Strategy

Key Insight: AI tools that offer customization can be adjusted to fit your specific trading style and goals.

Actionable Tip: Look for AI solutions that allow for the customization of algorithms, risk tolerances, and investment criteria.

While AI-powered trading tools can provide significant benefits, it's important to remember that one size does not fit all. The most effective AI trading strategies are those that are tailored to your unique investment style, risk appetite, and financial objectives.

When evaluating AI trading platforms, prioritize those that offer robust customization capabilities, such as:

- Algorithmic customization: The ability to customize the underlying machine learning algorithms to align with your trading approach and market insights.

- Risk management settings: Adjust parameters like stop-loss thresholds, position sizing, and hedging strategies to match your risk tolerance.

- Investment criteria: Personalize the stock selection and portfolio allocation criteria to target specific sectors, market capitalizations, or other characteristics that fit your investment goals.

By customizing your AI trading tools, you can ensure that the insights and recommendations generated are in sync with your unique trading strategy, ultimately enhancing the effectiveness and profitability of your AI-driven stock trading.

10. Balance AI Insights with Human Expertise

Key Insight: While AI provides powerful analytics, human intuition, and oversight remain invaluable.

Actionable Tip: Regularly review and interpret AI-generated insights with a critical eye, combining them with your own market knowledge.

As powerful as AI-powered trading systems may be, it's essential to remember that they are not infallible. While AI can provide unprecedented analytical capabilities, human expertise and intuition remain crucial components of a successful trading strategy.

To strike the right balance between AI insights and human decision-making, consider the following approach:

- Regularly review AI recommendations: Carefully analyze the recommendations and signals generated by your AI trading tools, ensuring they align with your understanding of the market and your investment objectives.

- Supplement with your own research: Complement AI-driven insights with your own research, market analysis, and intuitive understanding of trends and market dynamics.

- Maintain oversight and control: Avoid blindly following AI-generated trades; instead, maintain an active role in the decision-making process, leveraging the AI tools as a supplement to your own trading expertise.

- Continuously monitor and adjust: Regularly review the performance of your AI-powered trading strategies, making necessary adjustments to the algorithms, risk parameters, and investment criteria to optimize their effectiveness.

By striking the right balance between AI insights and human expertise, you can create a powerful and adaptable trading strategy that harnesses the best of both worlds.

In Conclusion

Incorporating AI into your stock trading strategy can be a game-changer, providing you with powerful analytical capabilities, enhanced decision-making, and the ability to capitalize on market opportunities in real time. By following the 10 tips outlined in this guide, you can effectively leverage AI to improve your trading performance and achieve your financial goals.

Remember, the key to success lies in striking the right balance between AI-driven insights and your own market expertise. Continuously review, adjust, and optimize your AI trading strategy to ensure it remains aligned with your investment objectives and risk tolerance.

Ready to take your stock trading to new heights with AI? Start exploring the best AI trading tools and platforms today, and unlock the full potential of this transformative technology.

Frequently Asked Questions (FAQs)

1. How do AI trading systems handle market volatility?

AI systems use real-time data and sophisticated algorithms to navigate and capitalize on market volatility, employing strategies such as dynamic risk management and rapid response to market movements.

2. Can AI trading tools predict stock prices with accuracy?

While AI tools leverage historical data and machine learning to forecast trends with high accuracy, predictions are probabilistic and not guaranteed, emphasizing the importance of diversified risk management strategies.

3. Are AI trading strategies suitable for beginners?

AI tools can significantly aid beginners by automating complex analyses and providing guided trading strategies. However, understanding the basics of stock trading and the mechanisms behind AI recommendations is crucial for effective use.